China’s Paradox Under Xi - Episode 2 of 7

A Sea /xi:/ of Macro Imbalances - a Story Told Through the Lens of its Bust Property Bubble. Eposide 2: Housing Development

Let us continue our journey on China, shall we?

In this episode, we will discuss in much detail the Chinese property development market. This episode is a key piece of the China puzzle before we can fully grasp and appreciate the CCP’s inner workings and the sea of macro economic imbalances that the country faces today.

Before we continue, let us briefly repeat the property picture as explained in the last episode:

China’s real estate sector is absolutely massive and analyzing it offers the best insight into the Chinese investment-led growth model. Understanding Chinese Real Estate is a prerequisite to understanding China’s economic woes today:

Real estate represents 25% of the Chinese economy, 36% of local government revenue, 70% of Chinese household wealth and 10% of Chinese employment.

It is also the most expensive space relative to GDP per capita in the world and, since 1992, has accommodated over 570 million of Chinese moving from agricultural jobs in the countryside to urban industrial employment.

But today, China’s real estate sector faces huge challenges: the equivalent of one and a half Japan standing vacant, one Netherlands available for sale and nearly one United States to be completed but not funded which remains full recourse to home buyers who already paid the full purchase price up front.

Housing Development: A Lottery Ticket on Completion

Between 1991 and 2023, Chinese citizens bought newly built residential housing, mostly apartments, for a total consideration of CNY 151 trillion or US$ 23 trillion, according to the National Bureau of Statistics (NBS). Note that in China, there is virtually no secondary market due to the poor quality of housing stock built before 1991.

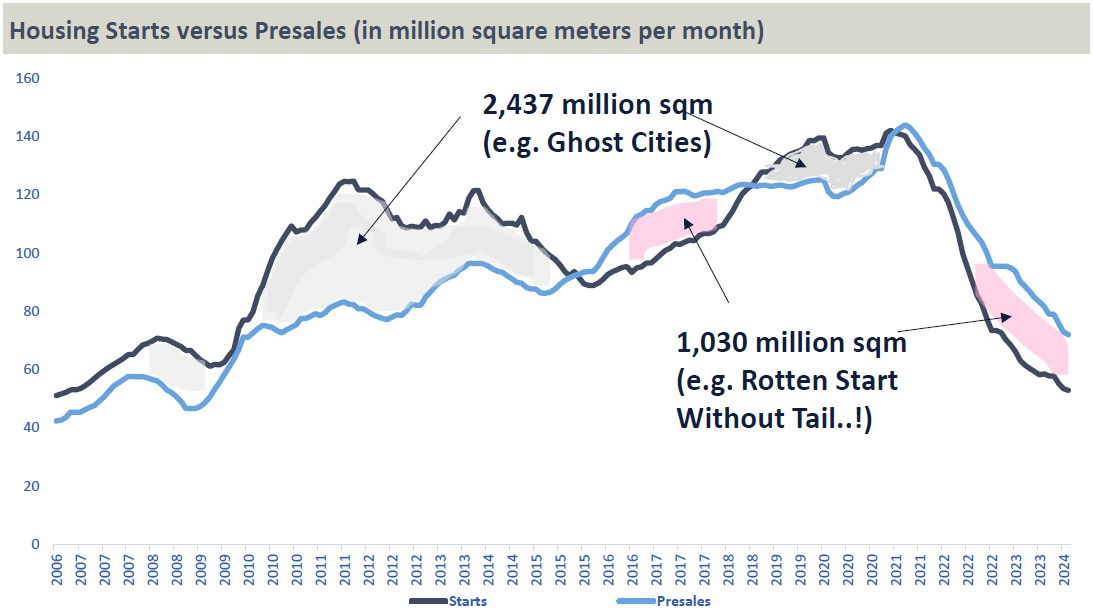

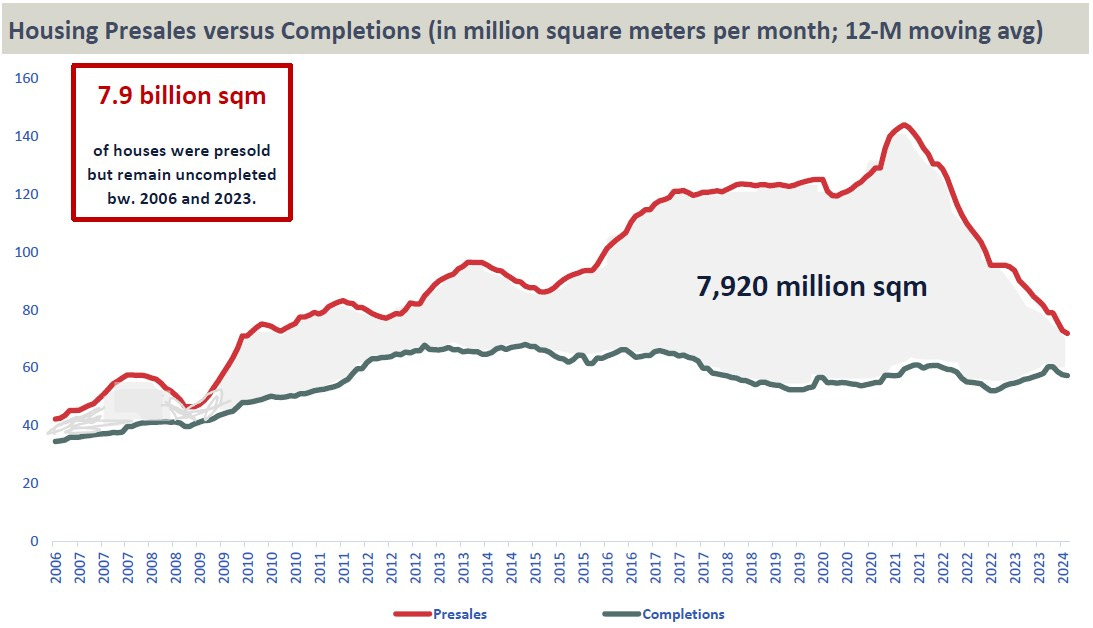

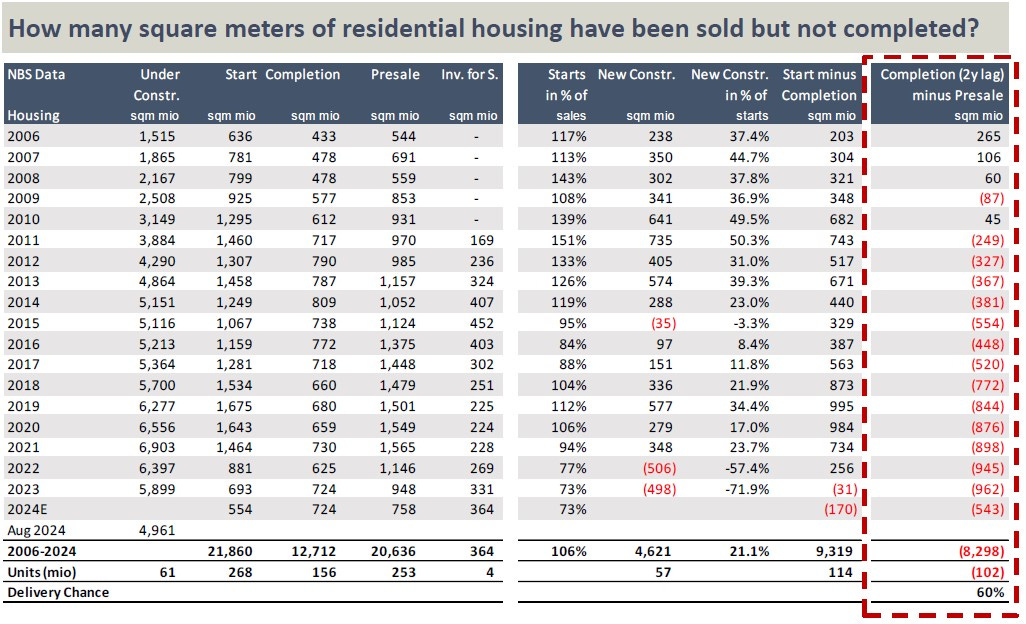

However, not everything that has been bought was actually completed. According to the NBS, between September 2006 and Dec 2023, Chinese developers pre-sold some 20 billion sqm but completed a mere 12 billion sqm, leaving 7.9 billion sqm to be delivered (grey area). At 82 sqm per unit, that equals 100 million of uncompleted housing or one Japan & Germany combined being left to be delivered. Disturbing!

If we add housing starts into the graph, the picture gets even more disturbing. Chinese developers started 21.3 billion sqm for the period or 8.3 bn sqm more than they completed for the period 2006 until 2023. That means they started 1.4 bn sqm more than they pre-sold. In theory that may mean they completed some unsold instead of pre-sold units which would imply an even higher uncompleted but pre-sold housing rate – nobody knows.

Comparing starts with pre-sales illustrates that developers started more units than they pre-sold for years (grey area). One reason goes back to China’s central-planning economy which ordered the development of entire cities first, only to populate them later. Conversely, developers also had phases when they pre-sold more units than they started, as they do right now (pink area). That meant some developers went insolvent and didn’t start the projects they pre-sold in the same year – think Evergrande or Country Garden. The Chinese have a name for such projects: “Rotten Tails”.

“Xiong’an New Area” is the latest example of building a Ghost town first and populating it later. Xi even called the city his “personal initiative”. The plan for Xiong’an was formally unveiled by the Central Committee of the Chinese Communist Party (CCP) in 2017 to “relieve pressure on Beijing” and promote the “coordinated regional development” of the Beijing-Tianjin-Hebei region. We will have to see about that…

China’s official housing data has been diverging, with the gap between cumulative housing starts and the sum of new homes under construction plus cumulative completions continuing to widen.

The data series were largely comparable BEFORE 2015. Now the chasm has reached 5.5 billion square meters as at August 2024.

Combining housing under construction and the chasm to housing starts results in a gap of 10.4 billion square meters. At an 82 square meter average, that would result in 127 million units that remain to be completed. For perspective, the USA has 143 million dwellings.

If we assume a two year lag between presales and completion and a constant completion rate of 724 million sqm for 2024 (a big if, you will find out soon), 8.3 billion square meters or 102 million homes have been presold but remain to be delivered.

However, only 61 million units (some of which may not have been pre-sold) are reported to be under construction as at August 2024. In other words, at this stage a prepaid home has at best a 60% chance (61/102) to be delivered if every square meter under construction were to be completed and assigned to a pre-sale transaction – both unrealistically optimistic assumptions.

If we were to add the chasm to housing starts, chances drop to 48% (61/127). Buying a home in China off-plan is a lottery ticket on delivery. In other words, for years buying an apartment in China was buying a lottery ticket betting on completion.

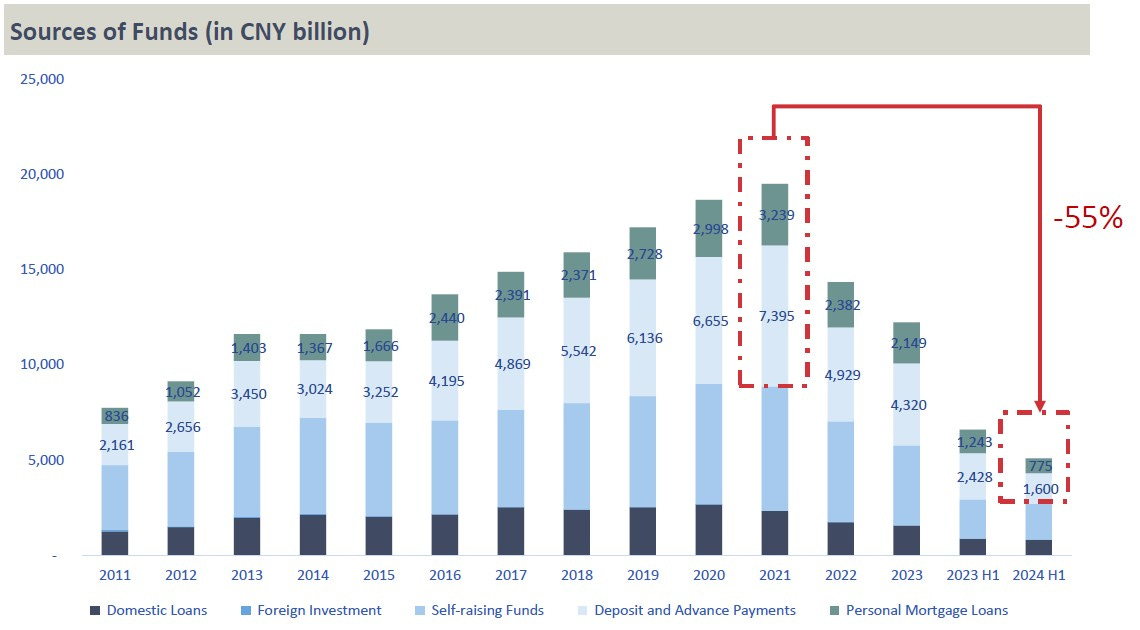

Meanwhile, the funding sources to complete apartments continue to dwindle alongside a slump in homes sales. China’s total funds in place for property development in H1 2024 fell 22% from a year earlier to CNY 5.4 trillion. Cash flows from customer presales (Deposits & Personal Loans) have collapsed by 22% year-over-year so far and may be down by more than 55% versus the 2021 peak, adjusted for a full year basis, as consumers lost confidence to buy off-plan while developers may not complete projects – a vicious circle.

On 19 July 2024, the IMF concluded a consultation with Chinese authorities with the urgent recommendation for a US$ 1 trillion property bailout targeted solely at China’s uncompleted housing stock. Chinese authorities rejected this proposal due to fears of moral hazard. The IMF wrote that “a clear strategy to address the large stock of pre-sold but unfinished housing by distressed developers is still lacking […].”

The IMF went on to state that “while data gaps make it difficult to precisely estimate potential costs […], staff calculations suggest that implementing such a scheme could entail fiscal costs of around 5.5% of GDP over 4 years.” That would likely add up to at least CNY 26 trillion (US$ 3.7 trillion) – just to complete unfinished housing projects.

Forgive us, but when certain individuals get bullish on Chinese stimulus due to a few hundred million here or there, we are afraid they haven’t done their homework.

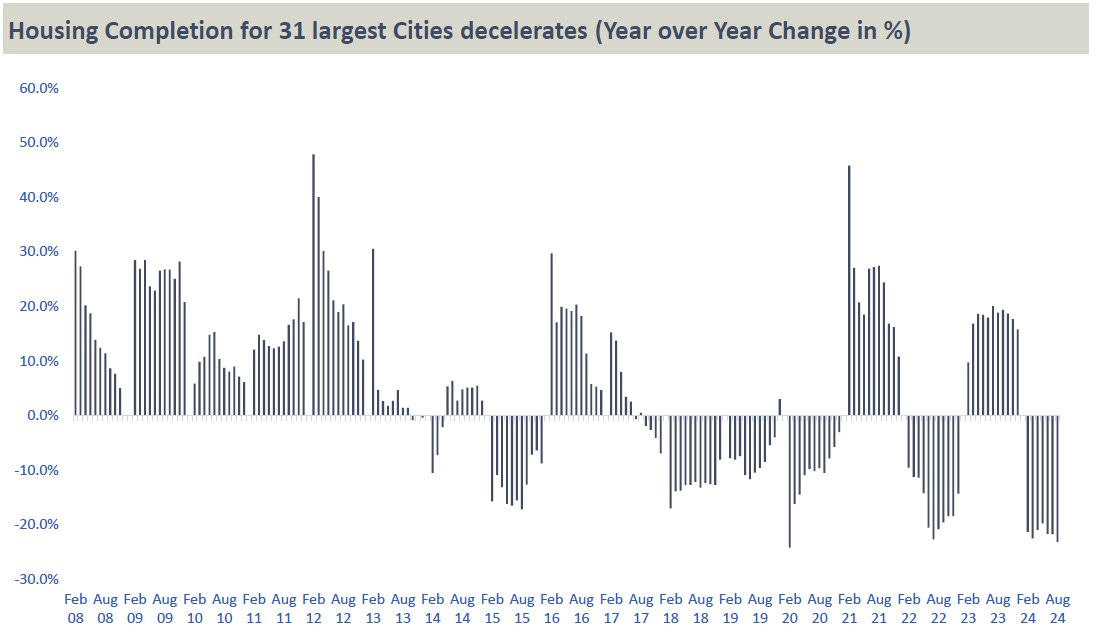

Housing completions for the 31 largest cities as reported by the National Bureau of Statistics suggest fewer completions in 2024, despite the ongoing efforts by the CCP to build more social housing. According to our assessment, completions peaked in 2014, remained relatively stable into 2017 and reduced steadily since. At the current completion pace, China would reach 2009-levels of around 560 million square meters or about 7 million apartments per annum – sobering for millions of Chinese who already paid for their home. On the above, the odds of the lottery ticket reduced further.

Three Red Lines: The End of Property Developers

Completing homes requires functioning property developers. However, in a bid to curtail China’s freewheeling real estate sector, in 2020 policy makers introduced debt metrics that set limits for property developers seeking to borrow more. Called the “Three Red Lines” by state-run media, they have become a game-changer for an industry that accounts for about 25% of China’s economic output.

But didn’t customers prepay their apartment in full before it was built and if so, why are developers in distress in the first place? Customers did prepay apartments in full. They had to by law.

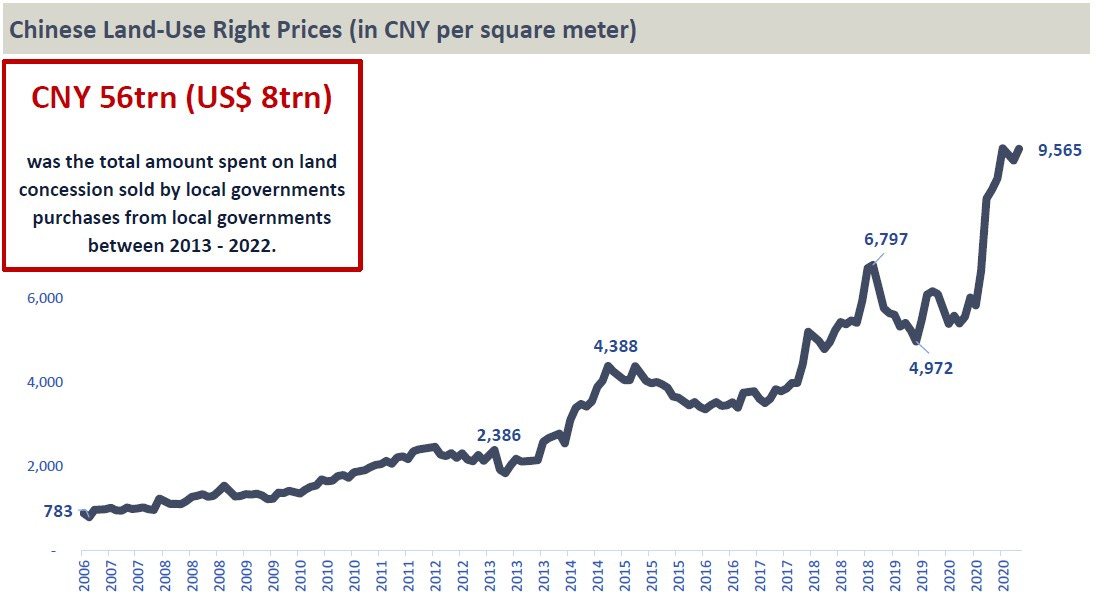

But Chinese developers – we mean all of them – sold apartments off plan and then largely misappropriated escrowed client money to purchase more land instead of completing the housing developments sold.

Again, all Chinese property developers have systematically misappropriated large parts of customer prepayments to secure landbanks for future development.

As land speculation took off post 2013, developers used more and more financial resources from pre-sales to speculate on land while completing fewer developments. Today, the sector needs a state bail out or future completions will collapse which the IMF estimated to cost 5.5% of GDP for five years. The question is, then what?

The misappropriation of down payments for other uses is illegal. However, while Chinese Urban Real Estate law defines that pre-sale receipts must be used for the completion of the relevant construction project prepaid, it does not define the compensation or penalty if that condition is violated by the developer - the law with Chinese characteristics!

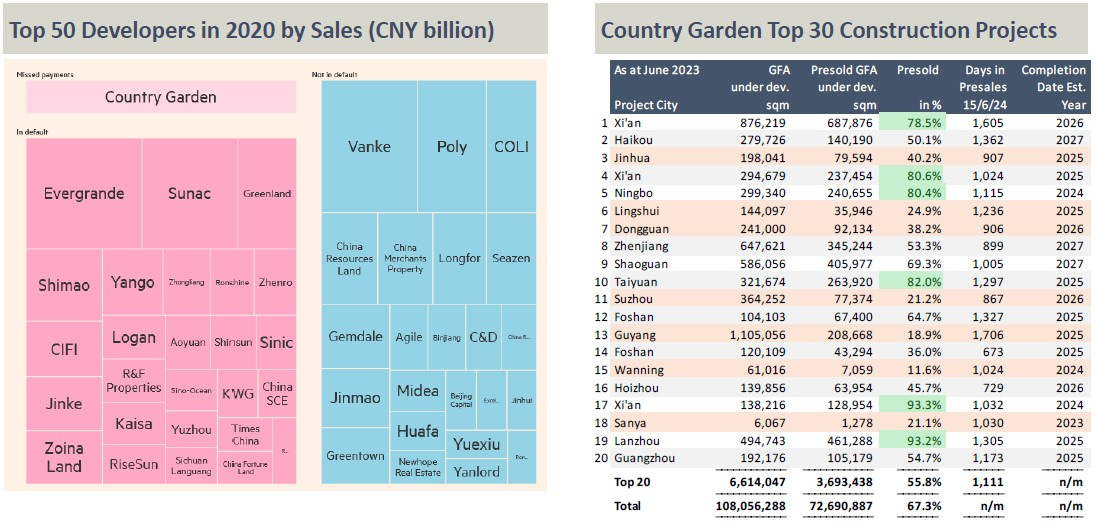

Combining the 21 largest developers as a group below shows fragility across the board. 14.5% less revenues over two years was enough to eat up 55% of EBITDA. Cash balances required to fund completions (as new loans are inaccessible) collapsed by 32%. What is left are CNY 3.5 trillion in debt and significant challenges to service it, let alone paying it back or completing any housing projects.

Nobody knows which housing projects will make the finishing line. A project that was 75% pre-sold in Shanghai, sponsored by a state-owned developer in compliance with the Three-Red-Line policies and whitelisted for government support has a good chance to complete.

A project that didn’t pre-sell well for 2-3 years, with a defaulted sponsor, will most likely join the Rotten Tails list. In between, there are endless combinatorics. But we dare to predict that unless the State will bail out the sponsors at large, a defaulted developer will struggle to complete even a 98% pre-sold project in Shanghai.

Large parts of the sector are simply insolvent at this stage. If they will not be bailed out at scale, their skilled workforce will be gone, too.

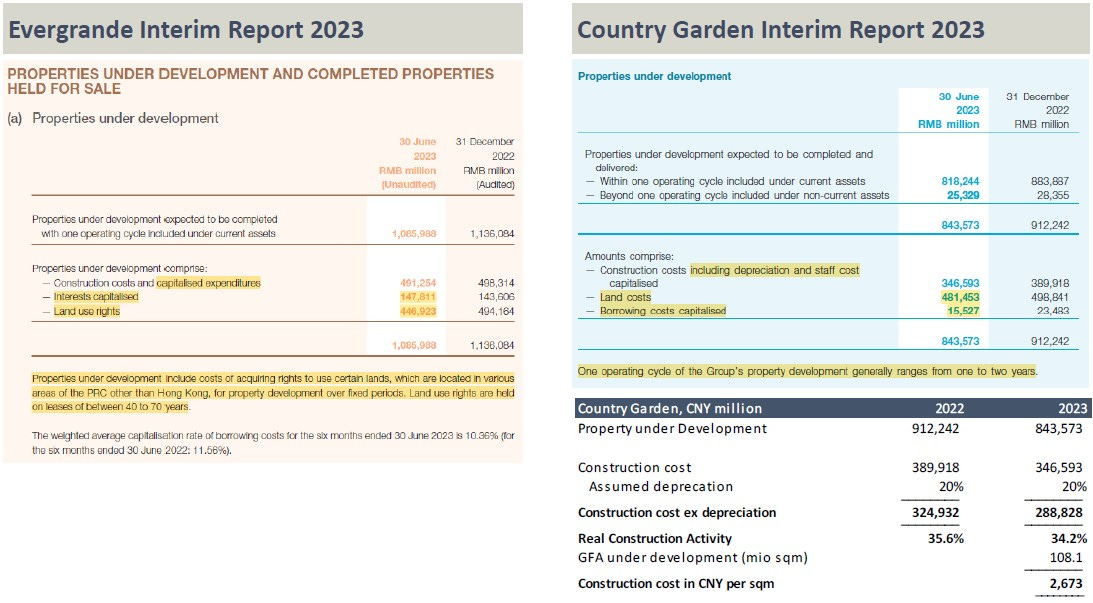

Studying the filings of Evergrande or Country Garden in more detail reveals more cause for concern. The accounting notes for “property under development” allocate some 65% to land-use rights, capitalized interest and depreciation. Nothing wrong with that. After all, land is part of the cost.

But if one dares to separate construction activity from inactivity for Country Garden, there remains a mere CNY 2,673 per sqm of “construction cost” left for the group or 11% of the average 50-City sqm price of CNY 24,300 in early 2023. In other words, when large scale developers show “properties under development”, there isn’t much development going on at all.

These simple, quiet images by Weimin Chu, a professional photographer based in Chongqing, tell a complex story of the suffering that the Chinese real estate crisis has inflicted on ordinary people…

Mortgage Boycotts & Bad Credit

As developers have even less money to complete projects now, housing completion delays grow longer. But remember: Chinese apartment buyers already pay interest on mortgages, even if such projects are delayed or do not get delivered at all. Such injustice drives mortgage boycotts as buying real estate in China has become a lottery ticket on delivery within a distressed property sector.

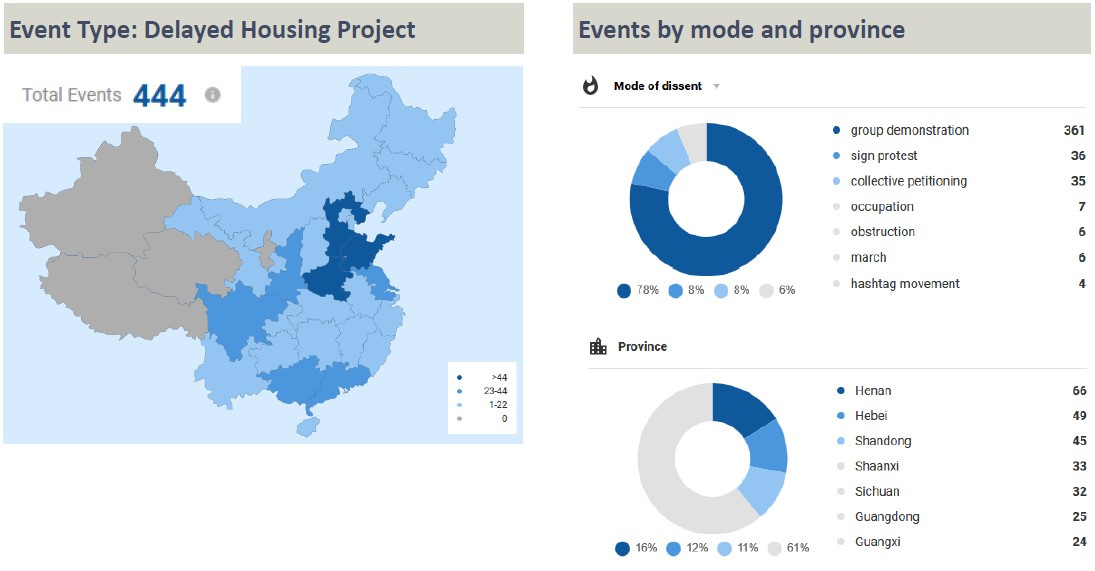

Between May 2022 and November 2023, the so-called China Dissent Monitor documented 444 events, with at times many thousands of participants demonstrating openly against the issue of “Rotten Tails”.

There were another 153 events on built quality and 19 on property pricing. The Dissent Monitor reported 2,464 events during this period.

Since November 2023, no new data has been uploaded, suggesting Xi’s conservative turn is now systematically suppressing the flow of information or protests themselves. Let’s leave that for later when we will get to China’s Mass Surveillance methods in a future episode in detail.

Until 2021, China’s middle class were excellent customers, dutifully paying their monthly bills. The government’s social credit system — a national credit rating and borrowing blacklist — worked well. For a reason: bad credit can even hamper one’s ability to take high-speed trains. But what if too many are just fed up or too broke and willing to walk away from their obligations?

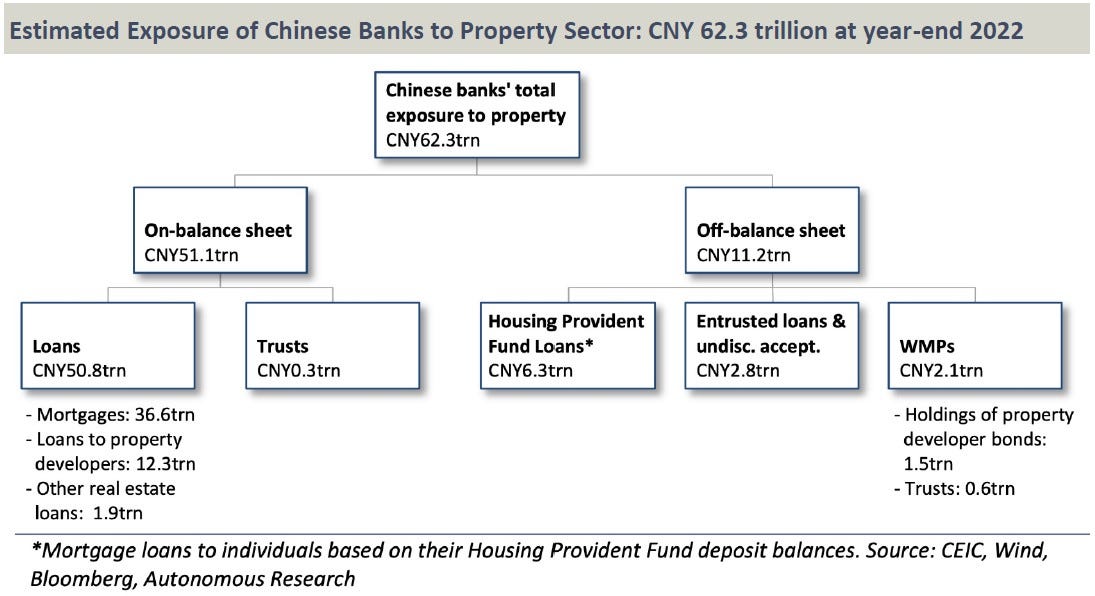

Chinese banks have a total loan book of CNY 237 trillion of which CNY 55 trillion, or 23%, are officially classified as related to real estate, including mortgages. Of the latter CNY 3.3 trillion, or 6%, are reported non-performing as at 30 June 2024 because interest is overdue by at least 90 days.

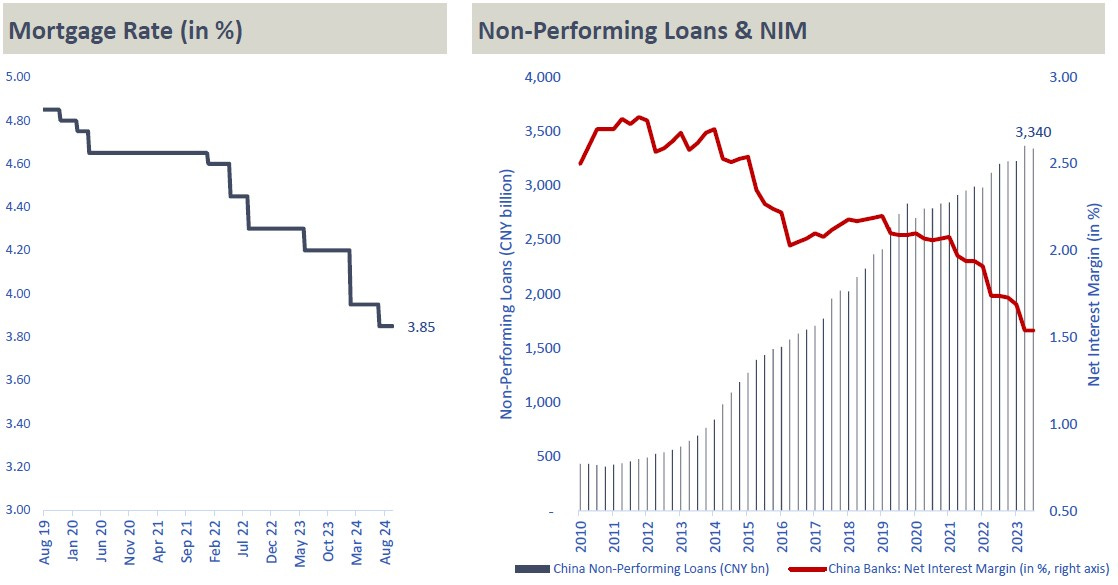

Meanwhile, recent Chinese stimulus packages reduced mortgage rates. The flip side? They squeeze bank revenues, the so-called Net Interest Margin (NIM). It stands at 1.54% now, which reduces the margin for error banks have to write off bad credit without the need for fresh equity capital.

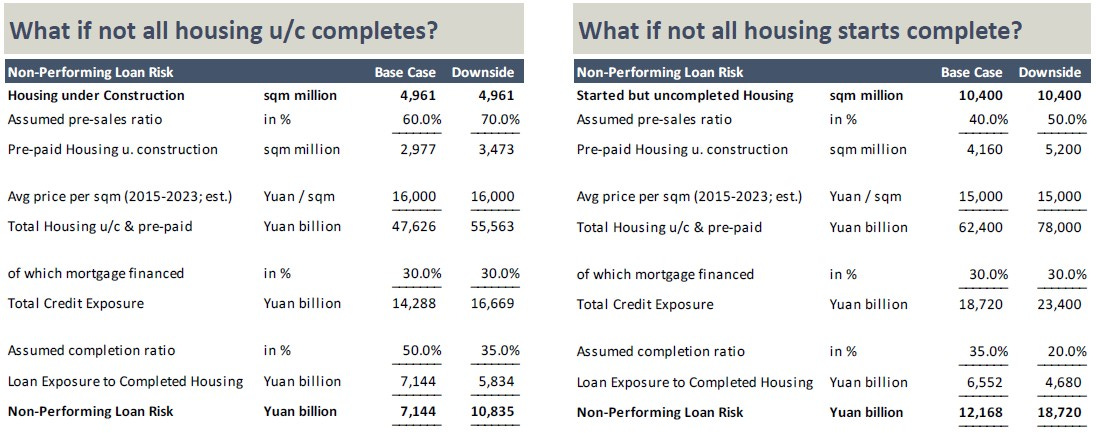

But what happens if sizeable write downs are yet to materialize in the property downturn? What if large parts of housing under construction cannot be completed because they remain unfunded? What if large parts of accumulated housing starts of 10.4 billion square meters, of which only 4.9 billion are under construction, remain uncompleted?

Well, then the CNY 3.3 trillion of non-performing loans in the Chinese banking system looks conservative. Base case, we assume that housing under construction can add CNY 7.1 trillion to non-performing loans of Chinese banks. When taking housing starts into consideration, the numbers grow to CNY 12.1 trillion, base case. These can only be estimates, but they show the magnitudes involved.

A large chunk of mortgage borrowings and related property loans is held – you guessed it – within a few State-Owned Banks. They mostly support companies according to the CCP’s 5-Year government plan.

Not surprisingly, the market has re-valued their price-to-book ratio down to 0.45x, implying CNY 8 trillion (US$ 1.1 trillion) of bad debt for the biggest 4 banks alone. Clearly, the market is sniffing out the problems of uncompleted housing within the property crisis yet to be reported.

Meanwhile, the PBoC continues to lower banks’ reserve requirements. A reduction in the ratio frees up cheap long-term funds for banks, allowing them to extend loans to businesses and consumers.

The flip side? It makes them more vulnerable to bad credit and write offs and subsequent capital refinancing. Therefore, one has to pay attention to the details that authorities explain when they announce a new “stimulus package”.

The CCP continues to, literally and figuratively, reduce its financial reserves from good times to keep the failed investment-led model from collapsing. But make no mistake, it’s a slow motion train wreck.

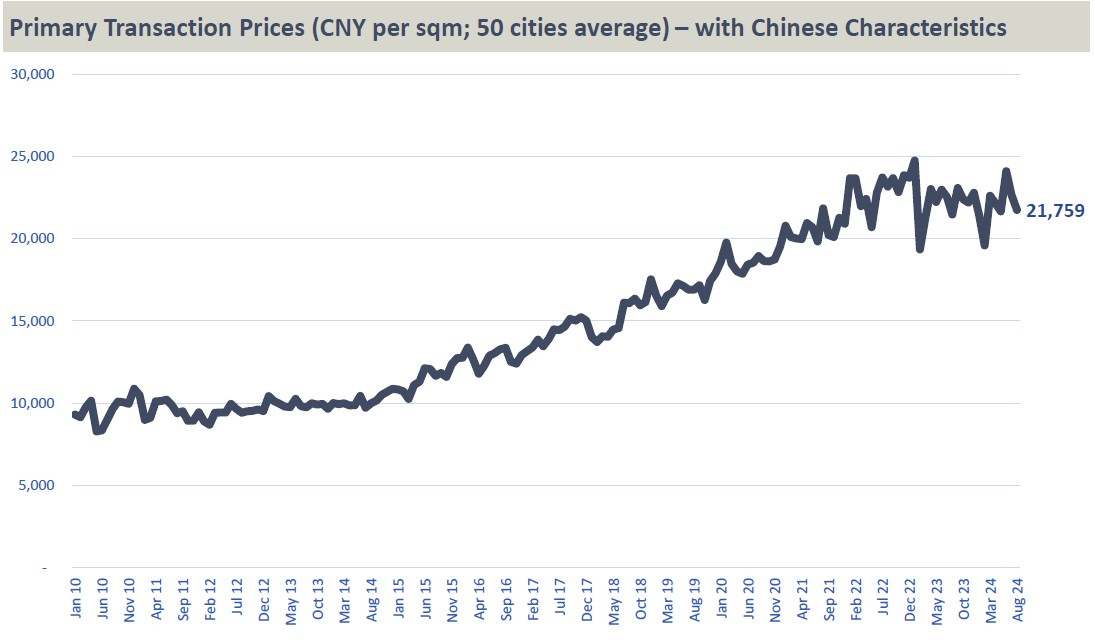

The most important collateral value in China’s banking system is real estate and to our surprise, house prices of pre-sold newly built houses remain remarkably stable. How so, given the circumstances?

Our understanding is that Chinese authorities disallow real estate developers to mark down prices of their project pipeline to keep the existing property asset values stable and avoid non-performing loan issues. If developers try to increase pre-sales via discounts, authorities cancel such transactions retrospectively. After all China is a command economy and prices must obey the CCP’s playbook. Potemkin would be proud of the Chinese authorities.

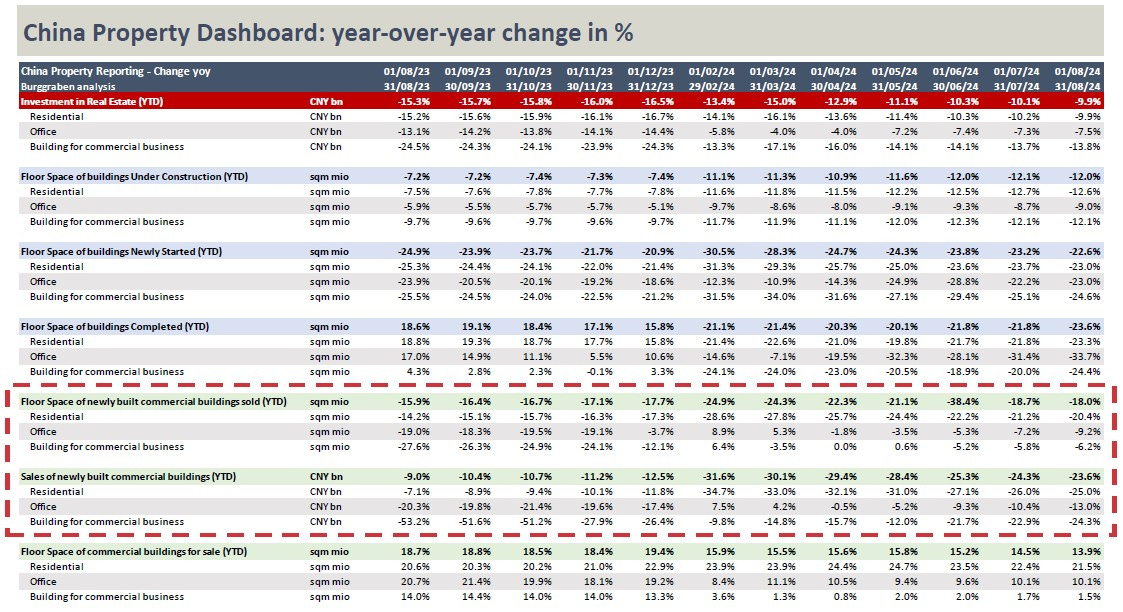

The CCP may be able to cancel property transactions to report the illusion of price stability with Chinese characteristics and thus keep officially reported non-performing loans from going through the roof. But the CCP cannot force individuals to purchase new apartments. Therefore, the below construction numbers are more representative of the sector. The real estate frenzy is over.

Executive Summary:

For years, prepaying a newly built apartment in China was the equivalent of buying a lottery ticket on completion.

Starting in 2014, the odds of housing completions reduced systematically due to the broad-based misappropriation of pre-sale receipts for land purchases by developers.

Today, the equivalent of nearly one United States remains uncompleted. But the odds of an apartment being completed is likely less than 50% as the entire development sector is in distress. This summer, the IMF wrote that “a clear strategy to address the large stock of pre-sold but unfinished housing by distressed developers is still lacking […].”

The IMF went on to state that “while data gaps make it difficult to precisely estimate potential costs […], staff calculations suggest that implementing such a scheme could entail fiscal costs of around 5.5% of GDP over 4 years.” That would likely add up to at least CNY 26 trillion (US$ 3.7 trillion) – just to complete unfinished housing projects. Does everybody really understand what this means?

Chinese real estate at current valuations represents 350% of China’s GDP, this is 2 times the ratio in the USA. The required reduction in sales prices and valuations and subsequent write-down of loans to project developers and mortgages to home owners would cause an immense shock to China’s financial system and its economy. It would also strain China’s central and regional government finances as well as household budgets to breaking point.

Does this mean broad based social unrest is coming? After all, tens of millions of households have to pay mortgages on projects that likely never complete. In our next episode we will explain why the property collapse in China has far reaching consequences, not just for consumers but also for local governments.

Stay tuned, we only started explaining our China story…

Unbelievable research and analysis that I have been searching for over a decade. Thank you!