China’s Paradox Under Xi - Episode 1 of 7

A Sea /xi:/ of Macro Imbalances - a Story Told Through the Lens of its Bust Property Bubble. Episode 1: The Chinese Housing Market

Our Message:

We at Burggraben have been warning about China on my Twitter profile, starting in 2022, and have become increasingly loud about it, rightly so.

Starting in 2023, the mainstream media picked up pace on important issues facing China today. Observers have come to understand that the property bubble has burst, that the economy is slowing down, that trade and geopolitical frictions are emerging, and that China has too much debt. But does it stop there? Do observers understand the underlying forces that drive these issues?

While the majority of these facts are known, we believe that most Western observers, investors and industrialists do not fully appreciate their interdependence and the seismic structural changes that are unfolding in China today. For too long, the CCP (Chinese Communist Party) had their back.

Observers are still waiting for the next stimulus package to emerge to then speculate on higher copper or oil prices. The Chinese stock market has proven that vividly in the past weeks. But what has worked for the past two decades is no more. China has changed. Ignore it at your own peril.

Our work aims to demonstrate where China’s economy stands today and where it is inevitably heading under Xi. Because we have a lot to explain, we will divide this into (6?) posts over the days and weeks to hopefully make this journey more digestible. As we are new here, we hopefully meet the right length and frequency for each of these posts.

Our work does not analyze cyclical aspects. You can easily look them up yourself. Instead, we analyze the structural realities of China under Xi in detail. And they are concerning.

Some of what we explain will be controversial. After all, we are an independent financial investor and aren’t bound to mince our words. But hopefully we back our views with enough relevant data insight for our readers to make up their own mind.

Let’s go…

Episode 1: The Chinese Housing Market

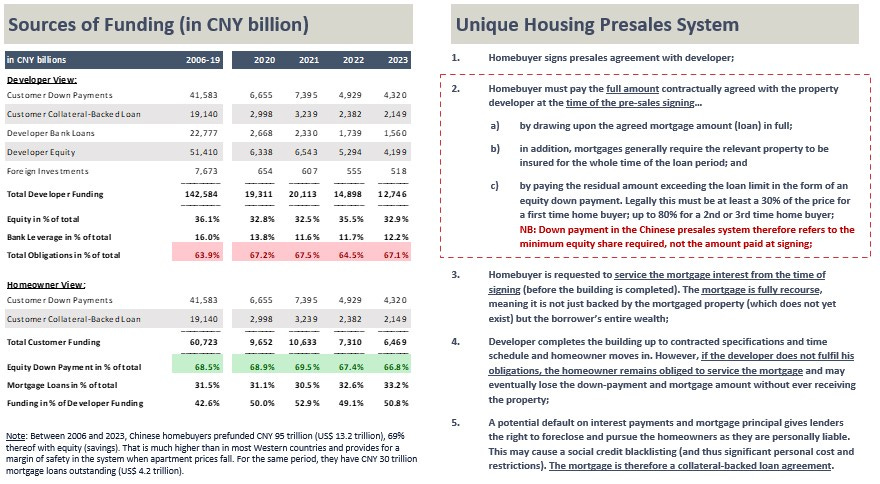

1. Unique Chinese Pre-Sales System

The Chinese housing system is built on pre-sales. Down payments for off-plan purchases of housing are not unusual features in most property markets. However, China requires homeowners to pay the full amount of the purchase price upfront, long before the apartment is completed. Also, China-style home loans leave the buyer carrying all the risk while incentivizing risky behavior by developers. Effectively, the system means the entire Chinese property market was built – to put it mildly – on a shaky foundation. In fact, it is a “house of cards”.

Don’t get confused. When reading news headlines about the Chinese housing market, articles may refer to the reduction or increase of “down-payments” from, say, 30% to 15% or vice versa. However, such headlines are likely misunderstood by most.

When international observers think about a housing down payment for a newly built home, they refer to PAYMENTS OVER TIME. The Chinese system, however, refers to the to the MINIMUM REQUIREMENT OF EQUITY FINANCING. But the buyer must always pay the FULL PRICE of the apartment upfront to the developer and years before the home is completed.

Before 2015, China didn’t have a secondary real estate market. Instead, buying newly built apartments (primary market) was required. However, its prevailing pre-sales housing system, where developers sell the apartment for the full list price before it is completed, based only on renderings and with an uncertain delivery date (instead of receiving down-payments pro-rata to completion), creates enormous conflicts of interest:

Under this pre-sales arrangement, property buyers provide a large amount of interest-free funds to developers which in turn greatly reduces their cost of capital and financial risk. It also provides an important source of income for banks (the interest on the mortgages) and the state (real-estate related revenue, both from land concession sales and taxes). In reality however, such a system creates inherent conflicts of interest.

First, it gives developers the false incentives to expand their pre-sale business instead of completing apartments already sold. They prefer to slow down the construction of a sold project that has been prepaid and instead collect more interest-free funds from new sales. They certainly have an incentive to cut corners on building quality. Once developers cannot deliver the apartments on time or to specification, financially weaker home buyers can hardly protect their rights. The system outsources completion risk to the home buyer, away from the developer.

What about the law and supervision of funds flow from pre-sales? That is also greatly compromised. Local governments must sell more land while developers require permits from them. Consequently, the legally required matching of prepayment withdrawal and actual project construction progress is ignored. Instead, the funds in escrow are used for land purchases, giving an even bigger incentive to delay completions – a vicious circle for home buyers.

Introduced with the property reform in 1998, the pre-sales arrangement allowed the rapid emergence of private sector property developers. Over time however, the pre-sales process entangled developers, buyers (borrowers) and lenders. After house buyers paid the full amount, once construction stalls, it becomes difficult to ascertain responsibility clearly.

2. Demographics

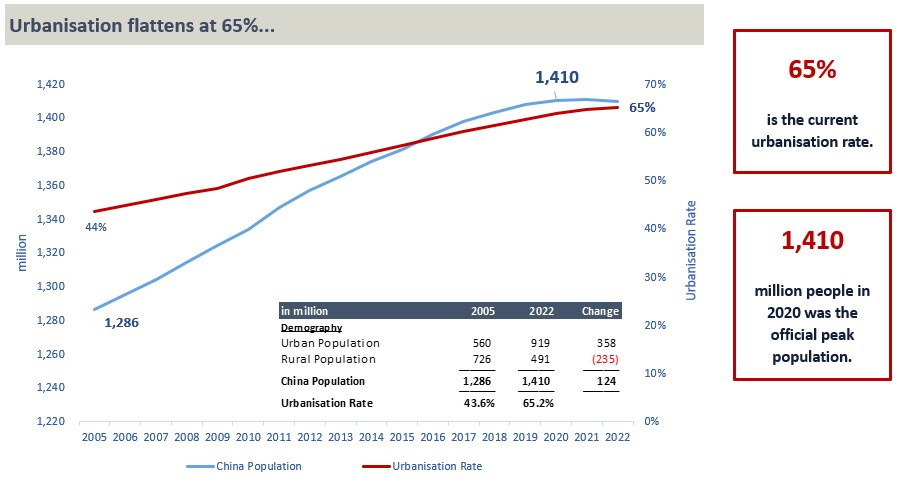

Meanwhile, the urbanization miracle is over. In 2005, China had a population of 1.3 billion people, still growing, of which 726 million lived on farms. Here comes the housing miracle. In only 17 years – the period we can measure – China’s property sector moved 235 million rural citizens to towns and cities. On top of that, it accommodated urban-only population growth of another 124 million for a total growth of 358 million urban people. But note that urbanization started to flatten in 2020 while the Chinese statistics bureau began reporting population decreases.

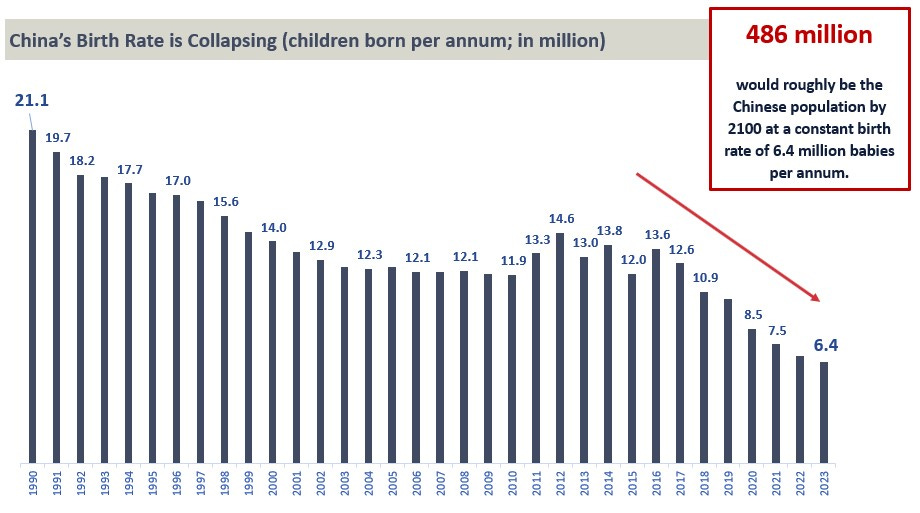

It gets worse. Over the past 34 years, China’s birth rate collapsed by 70% and currently stands at 6.4 million newly born babies in 2023. Since 1990 it has been on a downward trajectory - a direct consequence of introducing the one-child policy in 1979. Raising the limit to 2 and 3 children, before completely removing it in 2021, has failed to arrest the decline. Assuming a constant birth rate of 6.4 million moving forward (a big if) and given normal mortality of the existing population, we get to a population of 486 million people by 2100, a decrease of 65%. Who will buy a new apartment in the future with a flattening urbanization trend and such dramatic demographics?

New housing demand is further dampened by China’s high jobless rate for people between 16 and 24 years old. The statistics bureau stopped publishing the politically sensitive figure after it reached 21.3% in June 2023 and has since introduced a new calculation methodology, resulting in a lower figure. Given demographic headwinds, peak urbanization and significant youth unemployment, property demand from first time home buyers must be a challenge by now.

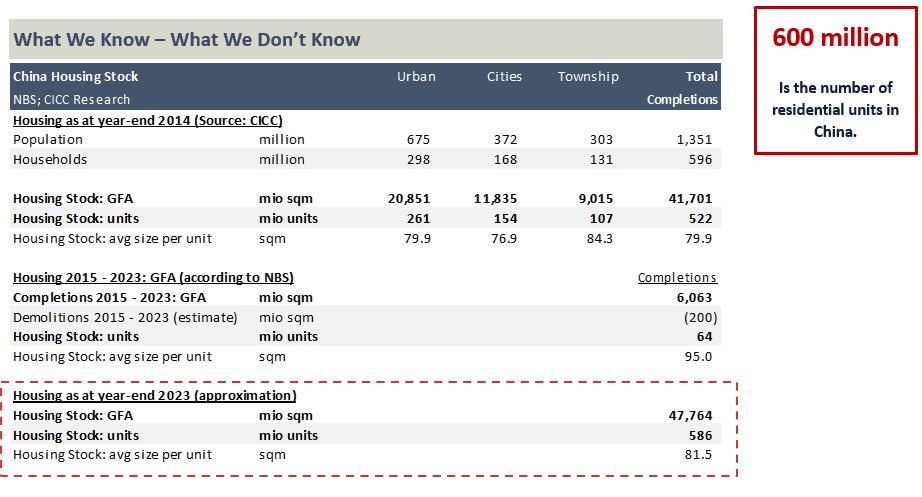

3. Housing Stock

China does not publish housing stock data. But the NBS offers a time series for housing completions dating back to 2009 while in December 2015, CICC (China International Capital Corporation) published some relevant statistics. Combining the two suggests that China has some 600+/- million residential housing units as at year-end 2023.

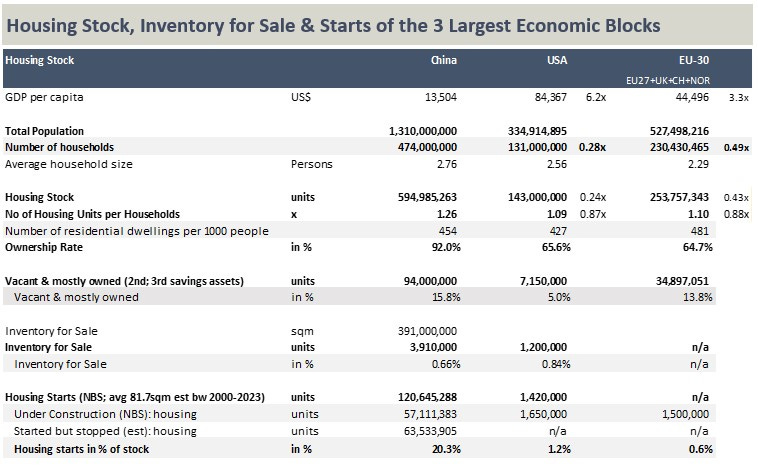

600 million houses is a lot of housing even for China. With a fraction of the GDP per capita of the US or Europe and a shrinking population forecast, it already has 10% more residential units per household than either of them. It also has significant vacancy - mostly owned - and inventory for sale. The real issue, however, is that developers already pre-sold 20% (!) of new homes that remain to be completed.

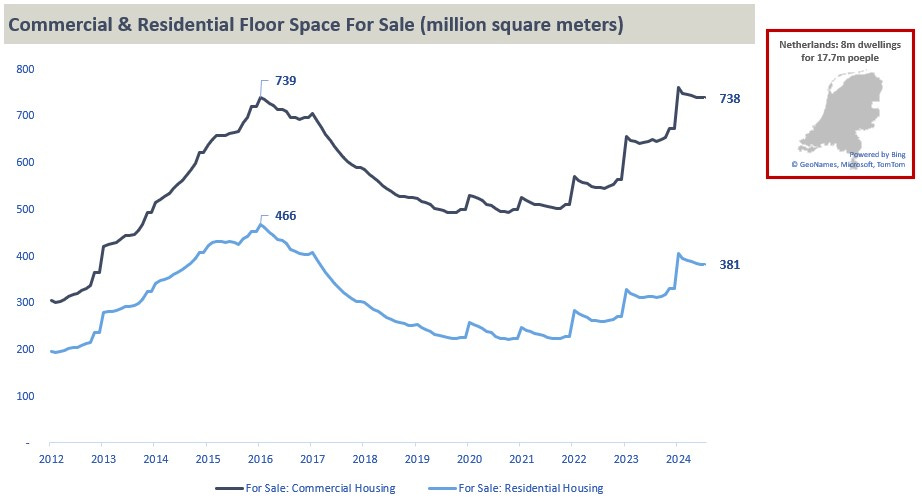

According to National Bureau of Statistics (NBS), China has the highest ever private sector property stock for sale in history. Housing inventory refers to dwellings that are completed but have not been sold or rented. 738 million sqm at an average size of 82 sqm would equal 9 million units that are for sale or rent for a total of about 24 million people. That is more than one Netherlands for sale.

One important observation is that the China’s property market doesn’t have sub-cycles for different real estate asset classes. This is due to its unique investment-driven growth model where entire cities get built first and populated later. Having said that, it seems that inventory stopped building in 2024.

According to our estimates most of cities within the top 50 will require around 3 years to clear their housing inventory at the current sales pace. Tier 2 city Harbin will require 8.5 years. Tier 3 city Yantai will require5 years. Even Beijing will require more than 2 years (28 months). Not good.

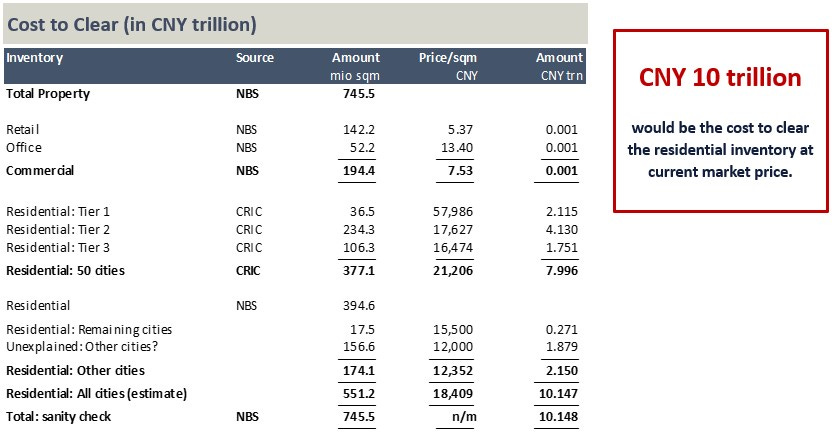

At current market prices, the cost to clear the residential housing inventory is estimated at CNY 10 trillion or about 8% of the Chinese forecast GDP in 2024. That is a lot of inventory, but remains manageable if it were to be the only problem.

4. Vacancy Rates:

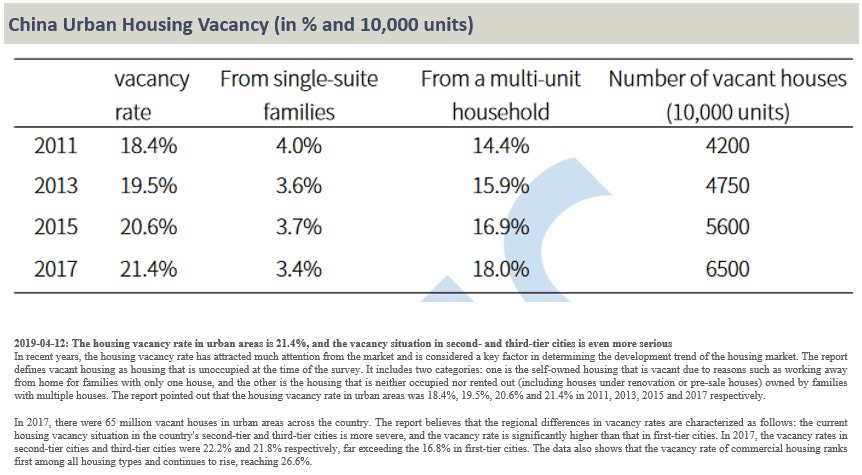

The Chinese government does not publish housing vacancy data. However, a professional study by a Chinese University suggests a 21% housing vacancy rate for the top 50 cities. The interesting part is that although these apartments are vacant most, if not all, of them have owners. Yet, the majority of these owners have no intention of moving in, let alone renting apartments out. The prevailing Chinese opinion is that renting out an apartment will lower its value.

In 2017, economist Gan Li and his researchers at Chengdu’s Southwestern University of Finance & Economics published their fourth national survey of Chinese households. Li figured that 70% of total household wealth is made up of the value of apartments. According to him, about 65 million units sat empty in the form of investments by the end of 2017.

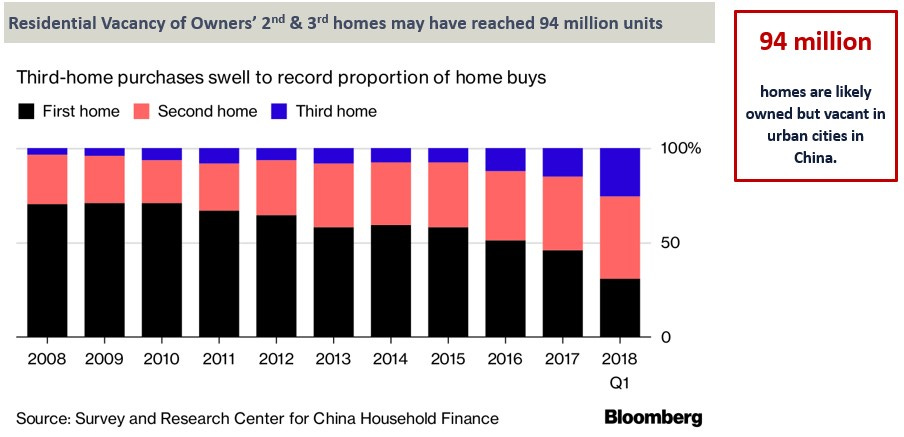

Professor Li was prohibited from publishing his fifth and sixth survey, as far as we can ascertain. But one can easily extrapolate his 65 million vacant apartments finding from 2017. Applying a similar trend for 2nd and 3rd home buying for the period between 2018-2023 (see below) would add another 28 million units for a total of 94 million vacant homes by year-end 2023. Assuming an average household size of 2.7 persons per unit, China could house another 250 million people in them or 75% of the population of the United States.

Graph 9: Second and Third Home Ownership

Double digit housing vacancies are not unusual for vacation destinations in Mediterranean Europe. But it is unusual that similar levels for secondary and tertiary home ownership exist in tier 2 and 3 cities in China, especially given their shorter useful life (often not even 50 years due to insufficient build standards) when compared to Western units (over 100 years). What are the reasons for this development?

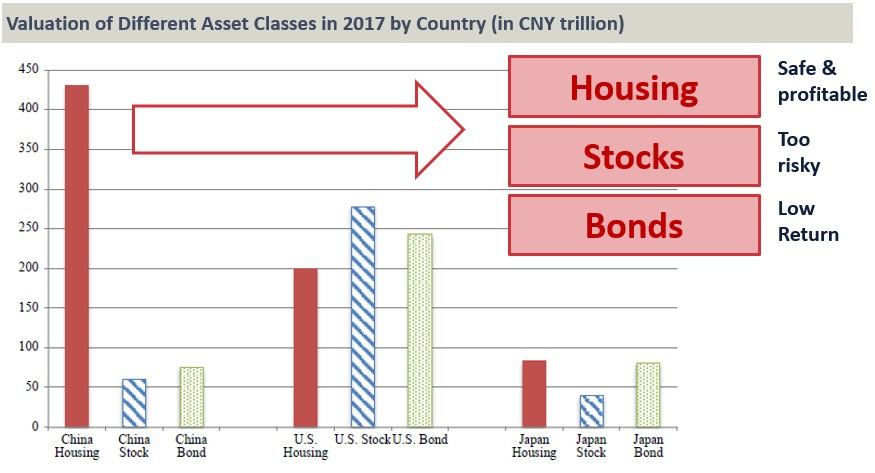

5. TINA - There is No Alternative

China’s passion for real estate began in the late 90s when the CCP teased privatization by offering state employees the right to buy their homes at steep discounts in what was intended as a form of welfare. Then, in the aftermath of the Asian Financial Crisis, the CCP opened the floodgates to everyone, supported by low interest rates. Of course, capital controls also matter greatly and that is why Chinese people didn’t have many alternatives to invest their savings.

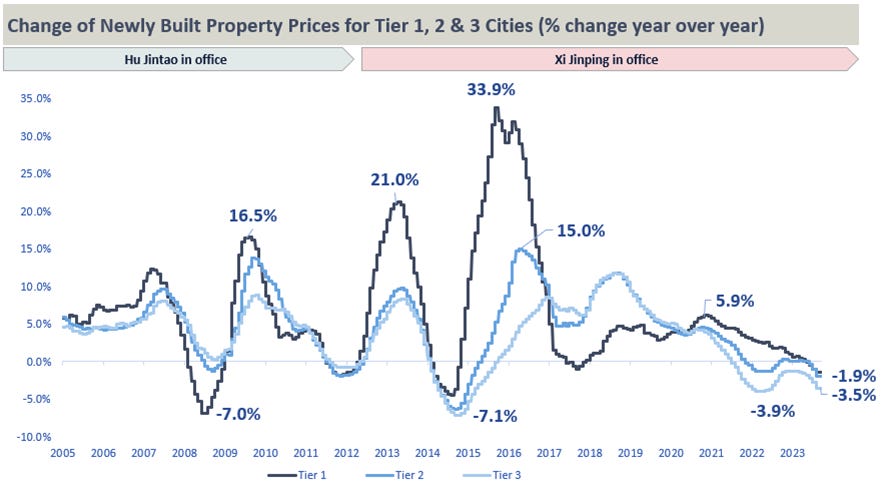

The love for “property-gold” was cemented by ever-increasing house prices (although not always in a straight line and at different speeds for different cities). With the exception of 2008 and 2014, prices always went up. The most extreme measure of this phenomenon was April 2016 when Tier 1 city values, these being Beijing, Shanghai, Guangzhou & Shenzhen, increased by 34% year-over-year.

A Peking University study suggests factors other than urbanization and the love for property are at play. Marriage seems to matter, too. With the sex ratio imbalance in favor of women, mothers-in-law, who play a key role arranging marriages, have become choosy. Everything else being equal, richer families with sons of marriageable age should be more appealing to the mothers of potential brides. One of the most visible symbols of this status competition comes through housing. Own a house and you are more likely to get a wife.

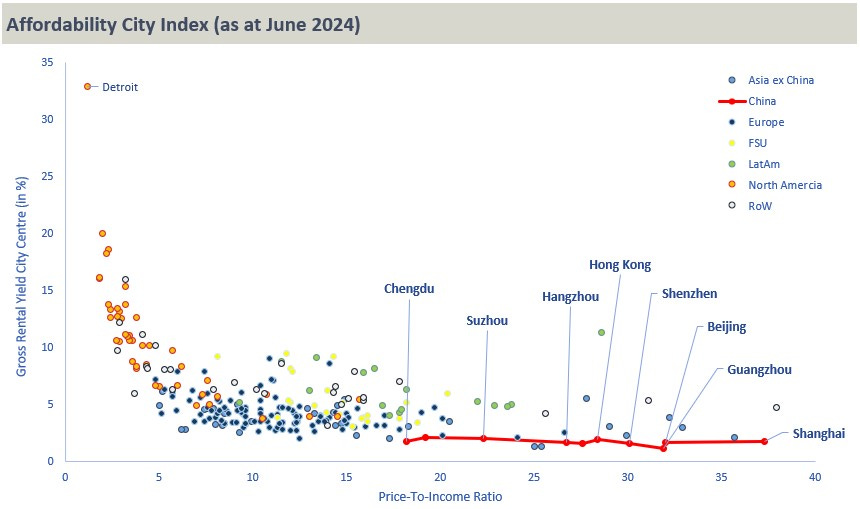

Meanwhile, prices climbed so high that home ownership basically became unaffordable, certainly so in an international context. As of April 2024, many Chinese cities are significantly less affordable than the world’s most expensive capitals. Today, China is host to likely the most expensive property on a price-to-income basis.

6. Summary:

China’s real estate sector is absolutely massive and analyzing it offers the best insight into the Chinese economic growth model. Real estate is representative of China’s workings and understanding it is a prerequisite to understand China’s economic woes today:

Real estate represents 25% of the Chinese economy, 70% of Chinese household wealth and 10% of Chinese employment, it is the most expensive space relative to GDP per capita in the world and, since 1992, has accommodated over 570 million of Chinese moving from agricultural jobs in the countryside to urban industrial employment.

But today, China’s real estate sector faces huge challenges: the equivalent of one and a half Japan standing vacant, one Netherlands is available for sale and nearly one United States remains to be completed (you read that correctly) but not funded (you read that correctly too) which remains full recourse to home buyers who already paid the full purchase price up front (we kid you not).

But we are getting ahead of ourselves. We will explain the Chinese property development sector in detail in our next post. It is a total shocker, so stay tuned. We have not even started to tell you our China story.

Best, Alexander

Burggraben Holding

PS: Some of you may have noted that we do not publish the many sources of our graphs & numbers. For those of you eager to replicate our work, feel free to download the full presentation with all relevant sources on our Website under the research section (paywalled).

Thank you. Great piece and some good stats.

I appreciate you are writing a structural piece not cyclical but most of this is well known.

China is now 3 years into the controlled demolition of its property sector and maybe another 2/3 years to get out. This doesn't preclude a cyclical bull market in Chinese equities.

The Chinese government is trying to stop the decline with its recent actions not go back to the "good old days" as they know this type of debt driven malinvestment goes nowhere.

Their recent actions and stimulus are an attempt to stop consumer confidence falling further and galvanize some of the over US20 Trillion in household savings to be spent.

Whether that is successful, remains to be seen, but we think there is a good chance it does stop the rot.

Excellent work Alex.